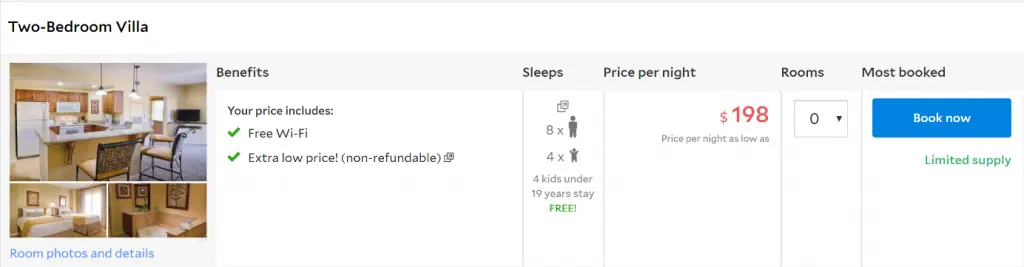

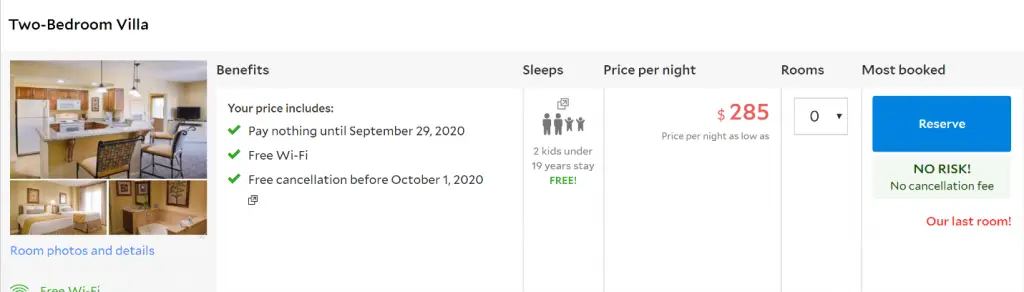

Have you ever wondered if you gain any advantage by being a timeshare owner over just renting your timeshare stays? Is there a cost savings? Are you aware that your timeshare is not exclusive like your salesperson promised? That often more than half of the guests you are sharing the pools and hot tubs with rented their stay through an online travel site? Did your salesperson tell you that you would save money or even lock out the affects of inflation by owning a timeshare? Unfortunately, we hear these stories all the time. Let us look at some examples of the cost of ownership vs the cost of being a renter.

Example 1

Cost of Ownership

| Initial Purchase Price (2 bedroom every year timeshare): | $30,000 |

| Total Paid by the end of the loan including finance charges*: | $57,254 |

| Maintenance fee per year: | $1,200 |

| Nights per year: | 7 nights |

| Average cost per night in the first 10 years of ownership: | $817.91/night |

Summary: I think it is obvious to say that you would be much better off renting instead of owning Diamond Resorts Las Vegas Polo Towers! Renters would save somewhere between $47,424.30 and $45,184.30 over the initial 10 years of ownership. That does not even include the other fees owners must pay when using their timeshare or the inflation rate of the maintenance fees! If you have owned your timeshare for more than a year you already know that maintenance fees go up an average of 4-6% a year.

Example 2

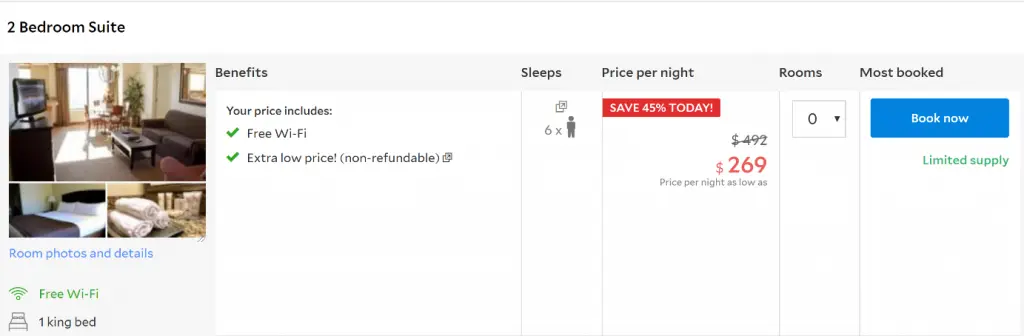

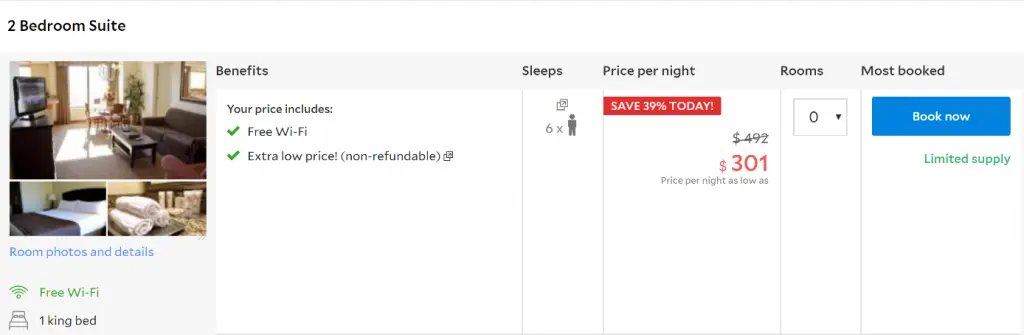

Wyndham Bonnet Creek Orlando

Cost of Ownership

| Initial Purchase Price (2 bedroom every year timeshare): | $35,000 |

| Total Paid by the end of the loan including finance charges*: | $66,796 |

| Maintenance fee per year: | $1,200 |

| Nights per year: | 7 nights |

| Average cost per night in the first 10 years of ownership: | $1,125.66/night |

Summary: Again, it seems obvious to say that you would be much better off renting instead of owning Wyndham Bonnet Creek Orlando! Renters would save somewhere between $64,936.00 and $58,846.00 over the initial 10 years of ownership. That does not even include the other fees owners must pay when using their timeshare or the inflation rate of the maintenance fees. If you have owned your timeshare for more than a year you are more that aware that your maintenance fees go up an average of 4-6% a year.

Many of you may find yourself in a state of shock at this point. This is not uncommon. Many timeshare owners were led to believe they were buying into a “private” resort and that non-owners could not even utilize the properties, much less at such a significantly discounted rate. Ever wonder why you cannot get reservations on the dates you desire? Next time, go to an online travel site and see if a renter has access to the time you cannot access as an owner. This is neither an acceptable nor fair practice and is one of the top reasons so many timeshare owners want out. Why wouldn’t they? If you can rent your timeshare for less than it costs to own and you are able to maintain the freedom and flexibility to vacation where and when you want, would that not be a better option?

Have you ever wondered why they rent your timeshare to non-owners at these massively discounted prices? It’s simple, really, timeshare companies are in the business of selling timeshares. If they rent units to non-owners, they have a pool of potential clients to pull into their sales center and pressure into buying. Why would someone renting a timeshare for less than $300 a night buy one, knowing it will cost them almost $1,000 a night? Much like your own experience, they never know what they are getting themselves into. These timeshare salespeople are trained to play on unsuspecting guests’ emotions. They often utilize high pressure and misleading sales tactics to get good people to make this disastrous decision. If this sounds like your own experience, it is not your fault. You may have been misled, and if you were, you can still get out. Call Centerstone Group. We are a powerhouse firm that specializes in securing our clients release from their timeshare obligations through our proprietary 3-pronged exit strategy. Do not make another payment before calling Centerstone Group for your free consultation. (949) 401-4111

*Finance assumptions: 10% down payment, 15.99% interest, and a 10-year term.

Know About Us